Dealing with a house in probate often stems from loss, adding layers of complexity to an already emotional time. Yet, understanding the process empowers executors or heirs to navigate it smoothly, potentially unlocking value from the asset without unnecessary delays. You’ll gain clarity on timelines, legal hurdles, and strategies that can save thousands in costs or disputes. For instance, probate sales typically require court oversight, which ensures fair distribution but extends closings beyond standard real estate deals.

Probate kicks in when someone dies without a trust, routing assets through court to settle debts and distribute to beneficiaries. If the estate includes property, selling might be necessary to pay creditors or divide proceeds. Expect a structured path: from executor appointment to final approval. State laws vary—California might demand bidding wars in court, while Florida focuses on appraisals first. On average, the full probate spans 6-18 months, with the sale phase taking 2-6 months once listed.

Benefits shine for those avoiding holding costs like taxes or maintenance. Cash buyers often step in for quick closes, though at discounts. Heirs can net proceeds faster than waiting for probate closure. Arm yourself with pros: attorneys handle paperwork, reducing personal liability. Pitfalls include rigid timelines and potential family conflicts over pricing.

Preparation matters. Gather documents early, like the will and death certificate. Consult specialists to appraise accurately and market effectively. This guide draws from proven practices to demystify each stage, helping you avoid common traps.

Insert image of a probate court document or estate property here.

Whether you’re an executor or beneficiary, knowing what lies ahead turns a daunting task into a manageable one.

The Basics of Probate and Property Sales

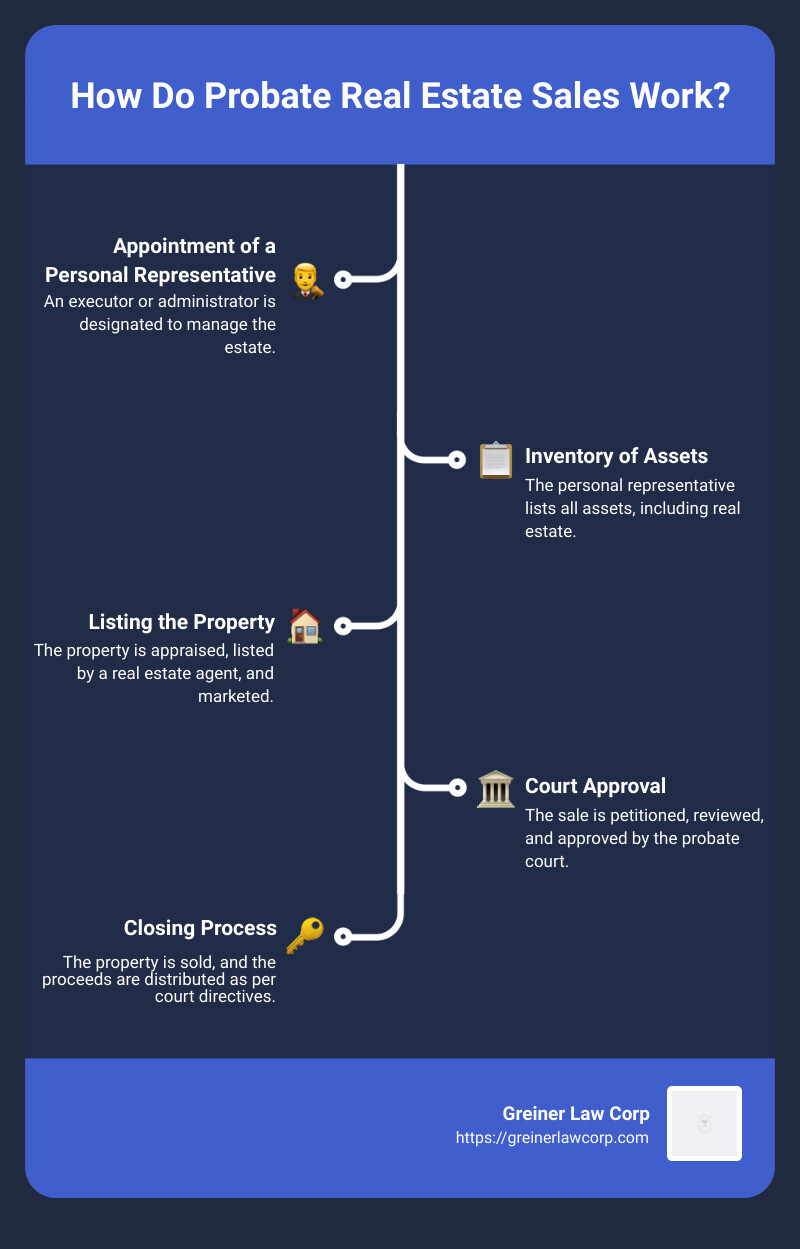

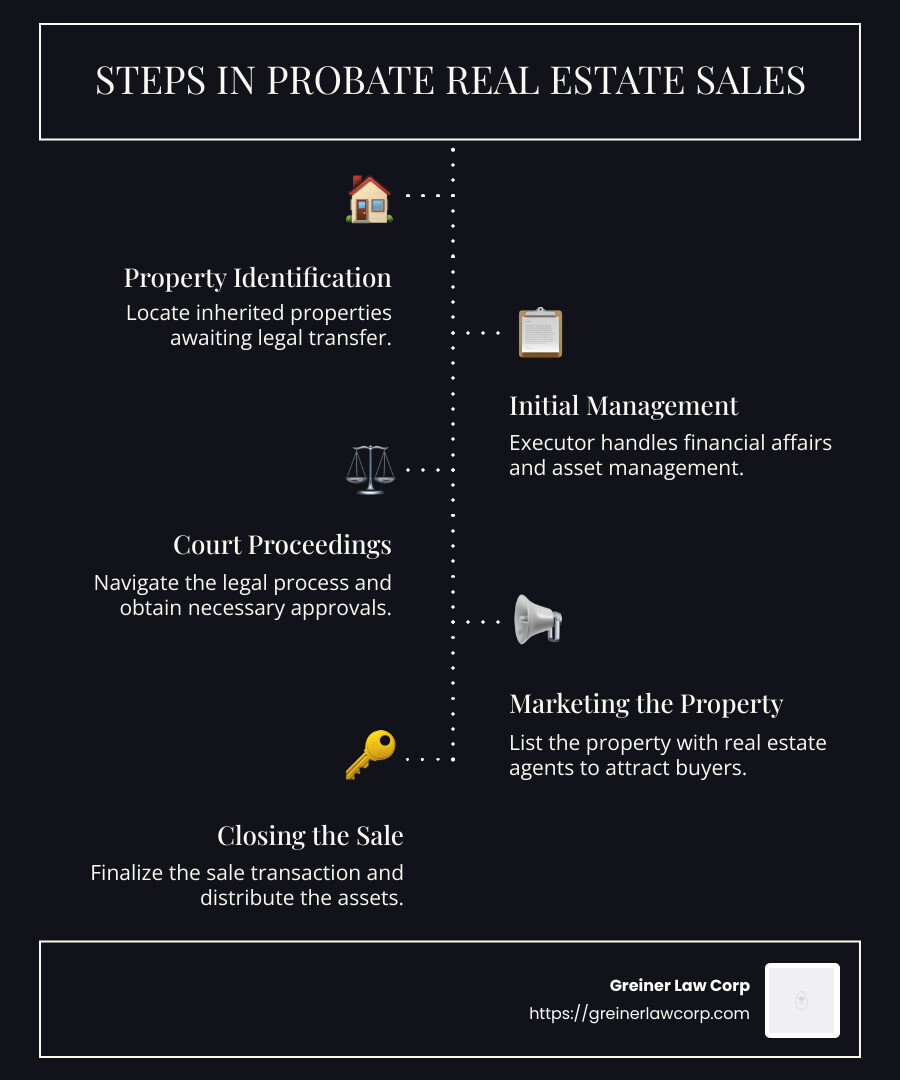

Probate validates a will and oversees asset distribution. When real estate is involved, the court appoints a personal representative—often the executor—to manage sales. This ensures debts get paid before heirs receive shares. Not all properties go through probate; those in trusts or joint tenancy bypass it.

Selling during probate requires court permission in most states. Start with an inventory: list the home’s value via appraisal. This sets a baseline for offers. In places like Florida, you’ll need a real estate agent and attorney early on. The process protects beneficiaries but adds scrutiny—buyers must understand the sale is “as-is,” often with no warranties.

Timelines vary. Simple cases close in months; contested wills drag on. Costs include court fees, attorney charges (1-4% of estate value), and appraisals ($300-500). Factor in holding expenses like utilities during delays. A real example: An executor in Texas sold a modest home in six months, covering debts and splitting $200,000 among siblings after fees.

Insights: Price competitively to attract buyers, as probate listings signal potential bargains. Disclose issues upfront to prevent later disputes. This foundation sets you up for a smoother transaction.

Key Steps in the Selling Process

First, file for probate in the deceased’s county. This takes 1-4 months, involving notice to creditors who have 3-6 months to claim debts. Once approved, appraise the property independently—crucial for court validation.

List the home. Use an agent experienced in probate for marketing. In some states, like California, sales go through overbid hearings where higher offers can trump yours. Accept an offer, but get court confirmation before closing. This step adds 30-60 days.

Closing mirrors standard sales but with extra paperwork. The representative signs deeds, and proceeds pay estate obligations first. For a $400,000 home, expect 5-7% in total costs, including commissions.

Tip: Document everything meticulously to avoid challenges from heirs. In one case, a Florida family sold swiftly by prepping appraisals early, shaving weeks off the timeline. Stay patient—rushing invites errors.

Common Challenges and Practical Solutions

Delays top the list—contested wills or creditor claims can extend probate beyond a year. Solution: Hire a probate attorney early to mediate disputes.

Family disagreements over sale price or timing arise often. Address by holding meetings to align on goals, perhaps using mediators.

Buyers may balk at “as-is” conditions, fearing hidden issues. Counter with inspections upfront, building trust. In South Dakota, sales average six months due to this scrutiny.

Tax implications: Capital gains apply if sold above basis, but stepped-up values help. Consult experts to minimize hits.

Overbids in court can upend deals—prepare buyers for this. A practical fix: Set realistic expectations from the start.

These hurdles, managed well, lead to successful outcomes without excessive stress.

Pros and Cons of Selling in Probate

- Pros:

- Court oversight ensures fair distribution, reducing heir disputes.

- Proceeds pay debts efficiently, easing estate closure.

- Attracts investors for quick sales in as-is condition.

- Potential tax advantages from stepped-up basis on inherited value.

- Cons:

- Extended timelines, often 6-12 months, increase holding costs.

- Required court approvals add bureaucracy and fees.

- Limited flexibility in pricing due to appraisals and overbids.

- Emotional strain from family involvement in decisions.

Alternatives and Quick Comparisons

Transferring property via living trusts avoids probate entirely—faster and private, but requires upfront setup unlike probate’s court protection.

Selling after probate closes offers more control over terms, potentially higher prices, but delays access to funds compared to during-probate sales.

Probate suits complex estates; trusts excel for simplicity.

Final Thoughts and Expert Advice

Selling a house in probate demands patience but yields structured results. Key: Engage professionals early for appraisals and legal guidance to streamline steps and cut costs. If debts loom, prioritize quick sales; otherwise, aim for market value.

Move forward by consulting a local attorney and agent. This positions you to handle realities effectively, turning inheritance into opportunity.

FAQ

How does court approval impact offer acceptance in probate? It verifies fairness, allowing overbids but ensuring the best deal for the estate, often boosting final proceeds.

Can heirs force a sale if one objects? Yes, with court petition if it benefits the estate, resolving stalemates and enabling equitable distribution.

What role do appraisals play beyond valuation? They support tax filings and creditor settlements, providing a defensible basis that minimizes disputes.

Are probate sales always “as-is”? Typically yes, shifting repair risks to buyers and speeding closes for sellers facing maintenance burdens.