AI transforms raw data into sharp forecasts for real estate trends, giving investors an edge in spotting opportunities early. This tech sifts through massive datasets to predict price shifts, demand patterns, and economic impacts with notable accuracy. For buyers and sellers, it means dodging overpriced deals or timing sales perfectly, potentially boosting returns by 15-20%. Traditional methods rely on gut feel and basic stats, but AI layers in real-time variables like job growth or consumer sentiment for precise outlooks.

Predictive models draw from historical sales, satellite imagery, and social media buzz to map future hotspots. One platform achieved 95% accuracy in price trends by blending these inputs. Developers use it to gauge rental yields, while agents tailor listings based on buyer profiles. Risks drop too—AI flags bubbles before they burst.

Efficiency gains matter. Automating analysis saves hours, letting pros focus on strategy. A report estimates $34 billion in industry savings through such tools. For individual investors, accessible apps democratize this power, turning complex markets into manageable decisions.

Yet, success hinges on quality data. Poor inputs lead to flawed predictions, so vet sources carefully. This article breaks down AI’s methods, with examples from leading firms. You’ll gain tips to apply these in your portfolio. Whether scouting commercial spaces or residential flips, understanding AI equips you to navigate shifts confidently. Expect clearer paths to profitable moves.

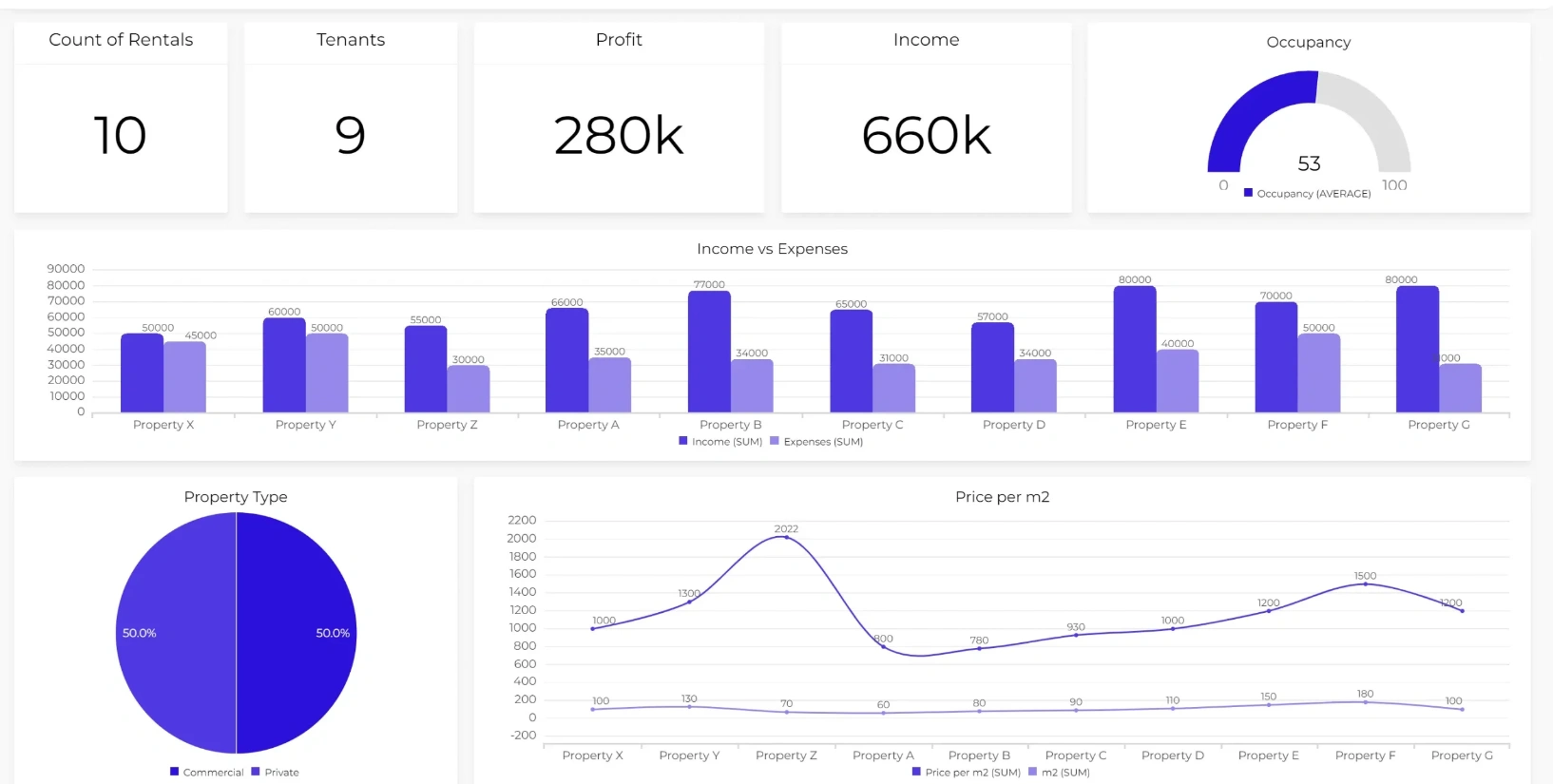

Insert image of AI dashboard analyzing real estate trends here.

The Core Mechanics of AI Predictive Models

AI relies on machine learning to forecast real estate trends. Algorithms process vast data, identifying patterns humans might miss. Supervised models train on past sales to predict future prices, while unsupervised ones cluster similar markets for broader insights.

Key is feature engineering—selecting variables like interest rates or population changes. Neural networks then simulate scenarios, outputting probabilities. For instance, convolutional networks analyze property images for valuation tweaks.

Practical tip: Use open-source tools like TensorFlow for custom models if you’re tech-savvy. Start small with public datasets to test accuracy.

In commercial real estate, AI predicts occupancy rates by factoring economic indicators. One firm used this to foresee a 10% rise in warehouse demand amid e-commerce growth. This approach outperforms traditional regressions, offering 20% better precision.

Integration with big data platforms enhances speed. Cloud services handle petabytes, updating forecasts daily. For investors, this means real-time alerts on shifting neighborhoods.

Overall, these mechanics turn uncertainty into strategy, aiding decisions from acquisitions to exits.

Data Sources Fueling Accurate Forecasts

AI draws from diverse streams for robust predictions. Historical transaction data forms the base, pulled from MLS databases. Economic metrics like GDP or unemployment rates add context.

Alternative sources shine: Social media sentiment gauges buyer interest, while geolocation data tracks foot traffic. Satellite imagery assesses urban development, spotting new infrastructure early.

Example: A tool analyzed Twitter trends to predict a suburban boom, aligning with actual 12% price hikes. This beats surveys, capturing unfiltered opinions.

Tip: Combine structured data (sales figures) with unstructured (news articles) via natural language processing. Tools like this identify emerging trends, such as green building demands.

Privacy-compliant aggregation ensures ethics. For global markets, incorporate currency fluctuations. This holistic view minimizes blind spots, delivering forecasts with up to 95% accuracy in stable areas.

Insert image of diverse data streams feeding into an AI model here.

Real-World Applications in Real Estate

AI applications span sectors. In residential, it forecasts price volatility, helping flippers time renovations. Commercial users predict lease renewals via tenant behavior analysis.

A developer employed AI to spot undervalued lots, yielding 25% higher returns. Agents use chatbots for personalized market reports, boosting client engagement.

Insight: For rentals, predictive maintenance flags issues, stabilizing income. Integrate with VR for virtual trend visualizations.

Challenges include data biases—diversify sources to counter. In volatile markets, hybrid models blending AI with expert input excel.

These uses drive decisions, from portfolio diversification to risk hedging.

Pros and Cons of AI in Market Trend Prediction

- Pros of Machine Learning Models: Handle massive datasets for 95% accurate price forecasts; enable real-time updates, spotting trends like urban shifts before competitors.

- Cons of Machine Learning Models: Susceptible to data biases, leading to skewed predictions in underrepresented areas; require computational power, raising costs for small investors.

- Pros of Sentiment Analysis: Captures public mood from social media, predicting demand spikes; adds qualitative depth to quantitative data for holistic views.

- Cons of Sentiment Analysis: Volatile to misinformation, potentially inflating bubbles; privacy regulations limit data access in some regions.

- Pros of Geospatial Integration: Uses imagery to forecast development impacts; improves location-specific accuracy for commercial investments.

Alternatives and Quick Comparisons

Traditional econometric models use statistical regressions on historical data. They’re cost-effective and interpretable but slower than AI, missing nuanced patterns like sentiment shifts.

Human expert analysis offers intuitive judgments. Pros include contextual understanding; cons involve subjectivity and scalability issues compared to AI’s data-driven precision.

What Investors Should Do Next

AI’s predictive power sharpens real estate strategies, offering accuracy and efficiency. Core values: reduced risks, timely insights, higher yields.

Begin with free tools for basic forecasts. Partner with AI-savvy brokers. Monitor model outputs against actuals. This builds confidence, turning trends into profits.

FAQ

How does AI incorporate climate data into predictions? It factors risks like flooding, adjusting valuations downward for vulnerable areas, helping investors avoid losses.

What makes AI better at spotting micro-trends? By analyzing local search data and mobility patterns, it identifies niche demands early, enabling targeted investments.

Can AI predict regulatory impacts on markets? Yes, through news scanning, it anticipates zoning changes, guiding development plans for compliance and opportunity.

How do ensemble methods enhance AI forecasts? Combining multiple models reduces errors, providing robust outlooks that adapt to market volatility effectively.