Mastering commercial property management unlocks steady revenue and long-term asset growth. For owners, it means minimizing vacancies while maximizing rents—often boosting net income by 10-20% through smart tactics. Managers benefit from streamlined operations that cut unexpected costs, like emergency repairs, and foster tenant loyalty for easier renewals. Think of it as running a business: Proactive steps turn offices, retail spaces, or warehouses into reliable performers.

Key perks include tax advantages from deductions on maintenance and upgrades, plus enhanced property values in competitive markets. With tools like software for tracking leases, you spot issues early, avoiding costly downtime. Real-world wins show this: A firm in Chicago used data analytics to reduce energy bills 25%, freeing funds for improvements. Risks lurk, such as regulatory changes, but solid plans mitigate them.

Start with basics. Assess your portfolio—size, location, tenant mix—to tailor approaches. For multi-tenant buildings, focus on common areas to build community. Single-occupant sites prioritize customized services. Tech aids here: Apps automate rent collection, slashing admin time.

This guide details proven methods, from tenant relations to finances. Draw on industry insights for practical advice. Whether handling one building or many, effective management builds equity. It demands attention but rewards with financial stability. Ready? Build a team—brokers, lawyers, tech pros—for support. Success lies in consistency, turning challenges into opportunities.

Core Strategies for Tenant Relations and Retention

Strong tenant ties anchor effective management. Screen applicants thoroughly—check credit, references—to avoid defaults. Clear leases outline responsibilities, reducing disputes. Regular check-ins build rapport; a quick survey can reveal needs like better lighting.

Retention saves money—vacancies cost thousands in lost rent. Offer incentives: Flexible terms or upgrades for renewals. In retail spaces, host events to boost foot traffic. Example: A Dallas mall manager added co-working areas, lifting occupancy 15%.

Communication shines. Use portals for requests, ensuring fast responses. Address complaints promptly—fix a leaky roof within days. Legal compliance matters: Adhere to ADA rules for accessibility.

Tips: Diversify tenants to buffer risks. In offices, mix tech firms with services. Track metrics like renewal rates; aim for 80%+. Software streamlines this, sending reminders automatically. These steps foster loyalty, turning renters into advocates.

Insert image of a property management dashboard here.

Maintenance and Operations Best Practices

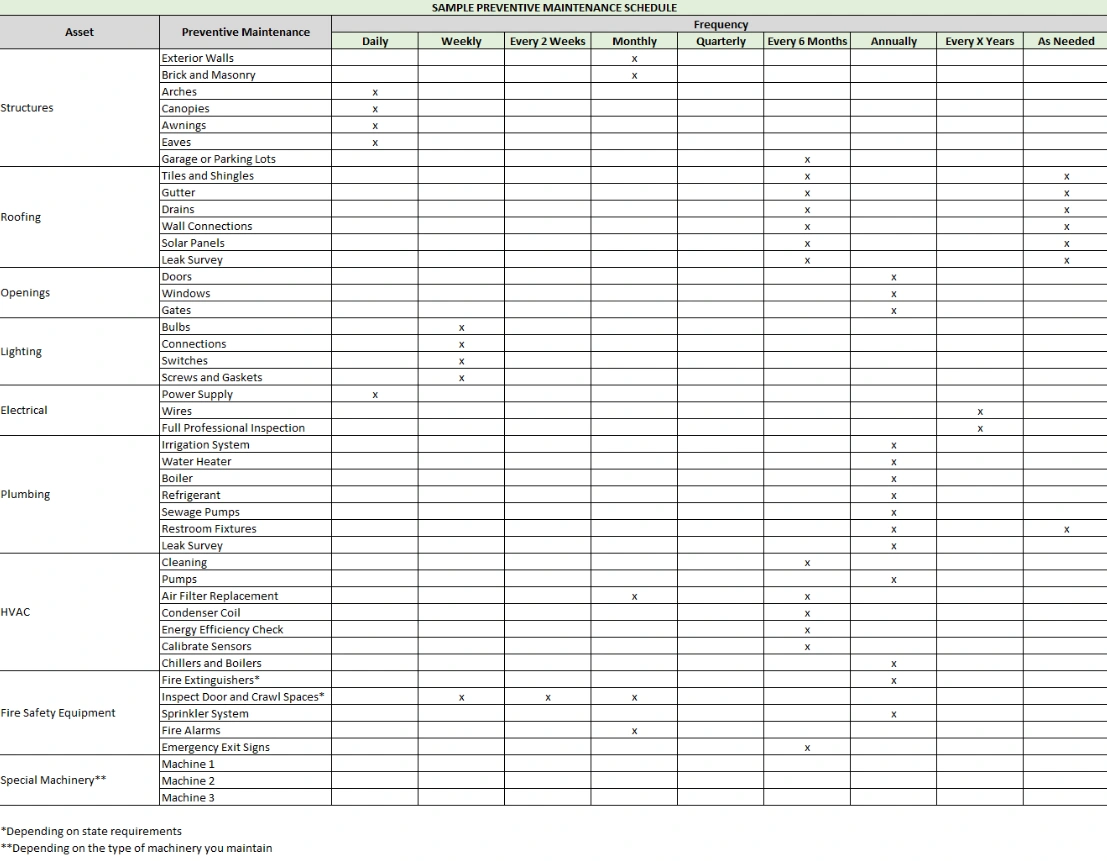

Proactive upkeep prevents big bills. Schedule inspections quarterly—check HVAC, plumbing, roofs. A checklist ensures nothing slips: Test fire systems, inspect electricals.

Outsource specialists for efficiency. Vendors handle landscaping or cleaning, freeing your time. Energy audits reveal savings: LED swaps cut costs 20%. Sustainability appeals too—green features attract eco-tenants.

Risk management is key. Insure adequately; review policies yearly. For storms, prep plans include boarding windows. A Florida property used hurricane-proofing, minimizing damage.

Practical insight: Budget 1-2% of value for maintenance reserves. Track via apps for real-time alerts. In industrial sites, focus on loading docks. These habits extend asset life, enhancing value.

Financial Management and Compliance Essentials

Sound finances drive success. Monitor NOI—rents minus expenses—monthly. Optimize by negotiating vendor deals or raising rents strategically. Software aids budgeting, forecasting cash flow.

Compliance avoids fines. Stay current on zoning, safety codes. Annual audits ensure adherence. Tax strategies: Deduct repairs, depreciate assets.

Example: A Seattle owner used analytics for pricing, increasing yields 8%. Tip: Diversify income—add vending or parking fees.

Legal savvy protects. Use attorneys for leases; include clauses for escalations. These practices secure profits, building resilient operations.

Pros and Cons of Effective Commercial Property Management

- Cost Savings Through Prevention: Regular inspections catch issues early, reducing repair bills by 20-30% in multi-tenant buildings.

- Higher Occupancy Rates: Strong tenant relations lead to 80%+ renewals, stabilizing income during market dips.

- Asset Value Growth: Upgrades like energy-efficient systems boost resale prices 10-15% in competitive areas.

- Compliance Assurance: Structured approaches minimize legal risks, avoiding fines from code violations.

- Initial Time Investment: Setting protocols and software takes weeks, delaying quick wins for new managers.

- Outsourcing Expenses: Hiring vendors adds 5-10% to budgets, though it saves on in-house staff.

- Market Dependency: Economic shifts can spike vacancies despite best efforts, impacting cash flow.

- Tech Learning Curve: Implementing dashboards requires training, potentially slowing adoption in small operations.

Alternatives: Self-Management vs. Professional Firms

Self-management suits small portfolios, offering full control and cost savings on fees. Pros: Direct tenant oversight, quick decisions; cons: Time-intensive and risky without expertise, versus professional efficiency.

REITs provide passive involvement through shares. Pros: Diversification, liquidity; cons: Less hands-on than direct management, with yields potentially lower at 5-7%.

Is It Worth the Effort?

Yes, for sustained gains. Effective management secures income and equity, outweighing upfront work. Audit your properties; hire pros if overwhelmed. Core value: Turns assets into thriving businesses.

FAQ

How does software streamline lease tracking? It automates reminders and payments, cutting errors 30% and ensuring timely renewals for steady revenue.

What role do energy audits play in management? They identify inefficiencies, saving 20% on utilities while supporting green certifications that attract tenants.

Can outsourcing maintenance improve tenant satisfaction? Yes; pros handle issues fast, boosting retention through reliable service without your daily involvement.

How do compliance checks prevent financial losses? Regular reviews avoid fines up to $10,000 per violation, protecting profits in regulated environments.