Receiving a cash offer on your home can change the game. It promises a fast close, often in weeks, without the headaches of buyer financing falling through. But many sellers leave money on the table by accepting the first number thrown their way. Cash buyers, like investors or iBuyers, expect discounts for their convenience. Smart negotiation flips that script, helping you secure thousands more without derailing the deal.

Start by grasping why cash offers appeal yet undervalue properties. Data shows cash sales make up about 19% of transactions, giving you leverage in a market where speed matters. Use this to your advantage—verify the buyer’s funds upfront to build trust and push for better terms. Research your home’s worth through a comparative market analysis (CMA) to counter lowballs with facts. In hot markets, highlight competing interest to create urgency.

Negotiation isn’t just about price. Factor in closing timelines, contingencies, and even small concessions like leaving appliances. Sellers who prepare often net 5-10% more than those who rush. For instance, if a buyer lowballs by 15%, counter with data on recent sales, aiming midway to invite dialogue.

Avoid emotional traps; treat it as business. With the right tactics, you turn a quick sale into a profitable one, freeing up capital for your next move.

Insert image of a seller reviewing a cash offer document with a calculator here.

This guide breaks down proven steps, drawn from real estate experts, to help you negotiate effectively.

Understanding Cash Offers and Their Negotiation Potential

Cash offers skip traditional hurdles like appraisals and loans, closing in as little as seven days. Buyers range from flippers to wealthy individuals, often seeking deals below market value for quick flips. Yet, they’re negotiable—don’t assume the initial bid is final.

First, request proof of funds, such as bank statements, to confirm legitimacy. This weeds out flakes and strengthens your position. Next, gauge market conditions. In seller-friendly areas with low inventory, emphasize demand to encourage higher bids. For example, mention other inquiries to spark competition.

Key is knowing your home’s value. A CMA from recent comps arms you with data. If your property lists at $400,000 and the offer comes in at $350,000, counter at $380,000, citing upgrades or location perks. Cash buyers value certainty, so offer flexibility on close dates for a price bump.

Remember, some buyers, like iBuyers, resist haggling, but networks connecting multiple offers let you compare and leverage better terms. This approach maximizes payout while keeping the process swift.

Essential Tactics to Boost Your Cash Offer

Preparation sets winners apart. Start with homework: analyze local trends and set a floor price. Tools like online estimators give baselines, but consult pros for accuracy.

Preparation sets winners apart. Start with homework: analyze local trends and set a floor price. Tools like online estimators give baselines, but consult pros for accuracy.

Tactic one: Counter boldly. If the offer feels low, respond promptly with justification. Highlight features like renovated kitchens to support your ask. For a $500,000 home, counter a $450,000 bid at $475,000, noting market comps.

Leverage competition. Disclose other interest ethically—say, “We’ve had multiple inquiries”—to prompt increases. In one case, a seller gained $10,000 by mentioning a financed backup.

Consider the full package. Negotiate beyond price; waive inspections for a higher sum or include furniture to sweeten without cutting proceeds.

Don’t rush. Cash buyers push speed, but hold firm if terms don’t align. Walk away if needed—this signals seriousness and often brings better offers.

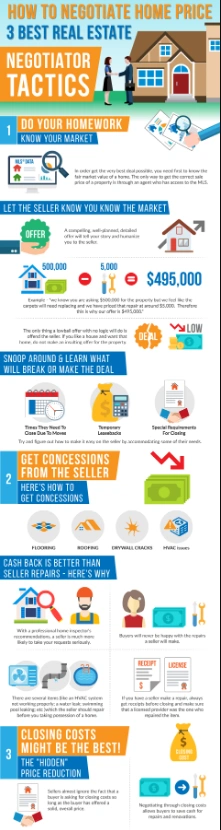

Infographic on real estate negotiation tactics for home sellers.

Vet buyers thoroughly. Check licenses and reviews to avoid scams, ensuring smooth closes.

These steps, applied consistently, can add significant value to your sale.

Common Pitfalls and How to Avoid Them

Sellers often stumble by accepting low offers out of excitement. Cash deals tempt with quick payouts, but rushing overlooks potential gains.

Pitfall one: Ignoring valuation. Without a solid CMA, you undervalue your asset. Solution: Gather data early to counter effectively.

Emotional decisions hurt too. Attachment to the home clouds judgment—focus on facts for better outcomes.

Failing to compare offers is another trap. Single bids limit leverage; use networks for multiples.

Overlooking terms beyond price, like fees or contingencies, reduces net proceeds. Review everything closely.

Finally, poor communication stalls deals. Be clear and professional to keep dialogue open.

By sidestepping these, you position for stronger negotiations and higher returns.

Pros and Cons of Negotiating Cash Offers

- Pros:

- Potential for higher payouts by countering initial lowballs with market data.

- Builds leverage through competition, often adding 5-10% to the offer.

- Maintains deal speed while securing better terms like flexible closings.

- Reduces risks by verifying funds upfront, ensuring reliable buyers.

- Cons:

- Risk of losing the buyer if counters push too hard in a slow market.

- Time spent negotiating might delay closing compared to immediate acceptance.

- Some cash buyers, like certain iBuyers, refuse haggling altogether.

- Emotional stress from back-and-forth, especially for urgent sellers.

Alternatives and Quick Comparisons

Traditional listings with realtors often yield higher prices—up to 30% more than cash—but take months with commissions eating 5-6%. Ideal for pristine homes in hot markets, unlike cash’s speed.

FSBO (for sale by owner) saves fees but demands effort in marketing and negotiation. It nets more than unnegotiated cash deals yet lacks expert guidance, risking lower offers compared to strategic cash haggling.

Cash negotiation shines for urgency; traditional methods win on profit maximization.

Final Thoughts and Actionable Advice

Negotiating cash offers demands preparation and poise, but the payoff justifies it. Arm yourself with valuations, leverage competition, and counter confidently to extract maximum value. For most sellers, this means netting thousands extra without sacrificing speed.

Start today: Get a CMA, solicit multiple offers, and review terms meticulously. If your situation calls for haste, prioritize verified buyers. Ultimately, treat it as a business move—you’ll walk away stronger.

FAQ

How can I tell if a cash buyer’s offer is too low? Compare it to recent comps via a CMA; if it’s below 85% of market value, counter with evidence for a fairer price.

What if the cash buyer won’t budge on price? Offer non-monetary perks like including appliances, or walk away to pursue better offers from networks.

Does negotiating extend the closing timeline? Rarely, as cash deals close fast; smart counters keep momentum while improving terms.

Can I negotiate fees in a cash sale? Yes, push for the buyer to cover closing costs, boosting your net by 1-2%.